The History of Central Banking in America

- truth81

- Feb 4, 2023

- 16 min read

February 3, 2023

by Ryan DeLarme | Badlands Media

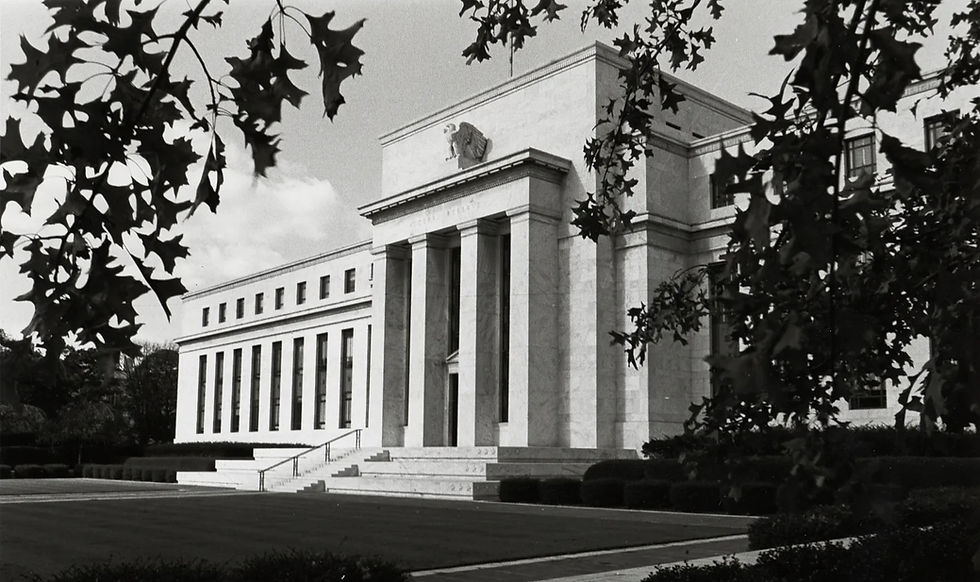

Housed in the menacing Eccles Building in Washington, DC, just south of Foggy Bottom at the intersection of 20th Street and Constitution Avenue, is the main office of the FED’s Board of Governors. (#) This iconic building harbors an institution both celebrated and reviled, but generally misunderstood.

So, what exactly is the Federal Reserve System?

The answer may surprise some of you. It is not federal, and there are no reserves. Furthermore, the Federal Reserve Banks are not even proper banks. Most people are at least aware that the FED controls and prints our currency, but are largely clueless as to the deeper mechanics involved.

Prior to the Federal Reserve Act, at the end of the 19th century, the United States had what you could call a decentralized private banking system, which was in a sense governed by the whims and cycles of capitalism, with booms and busts and all that good stuff. (#) Before 1913, there was no “national currency." Instead, banks would actually issue their own notes, not completely unlike our modern crypto market.

Why create a Federal Reserve? Here’s the short answer:

Several economic “waves of panic” over the course of a few short years led to a series of what we call “bank runs,” which occur when a large number of customers of a bank or other financial institution withdraw their deposits simultaneously over concerns of the bank's solvency. (#) These panics led to the formation of a National Monetary Commission that would be tasked with brainstorming ideas about how to create a more stable economic system.

This commission inevitably led to the creation of the Federal Reserve, and now we return to the question at hand: what is it?

The Federal Reserve System (also known as the Federal Reserve or simply “the Fed”) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act. As we mentioned, its creation came after a series of financial panics (particularly the panic of 1907), which really drove the public's desire for central control of the monetary system in order to alleviate financial crises. (#)

Over the years, events such as the Great Depression of the 1930s and the Great Recession of the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

In a nutshell, the Federal Reserve Act required that the US Congress establish three key objectives for monetary policy: maximizing employment, stabilizing prices and moderating long-term interest rates. (#) The first two objectives are sometimes referred to as the Federal Reserve's “dual mandate.”

So, now that we’ve covered the basic explanation, let’s get into the juicy and sordid history of the Federal Reserve's creation.

The First Two Central Banks

To fully grasp the weight of what we are about to discuss, it is important to note that there has long been a class of international money changers who have typically seen themselves as above nations and their elected leaders. They rule by way of creating private central banks and loaning out money with interest (also known as usury), thereby controlling nations through perpetual debt.

At least that’s what the “crazy conspiracy theorists” say.

At this time the country had already seen a couple of central banking institutions come and go. A significant portion of the founding fathers were strongly opposed to the formation of a national banking system; the fact that England tried to place the colonies under the monetary control of the Bank of England was seen by many as the "last straw" of oppression, which led directly to the American Revolutionary War. (#)

But there were some who were in favor of a national bank. A man named Robert Morris, as Superintendent of Finance, helped to open the Bank of North America in 1782.

The Articles of Confederation had extended to Congress the sovereign power to generate bills of credit; later that year, it passed an ordinance to incorporate a privately subscribed national bank, following in the footsteps of the Bank of England. (#)

However, it was thwarted in fulfilling its intended role as a national bank due to objections of "alarming foreign influence” and “fictitious credit.”

In 1791, a former Morris aide and founding father Alexander Hamilton, then Secretary of the Treasury, accepted a compromise with Southern legislators to ensure the continuation of Morris's Bank project from a decade before. (#)(#) As a result, the First Bank of the United States (1791–1811) was chartered by Congress within the year and signed by George Washington himself soon after.

It wasn't long before the same central banking shenanigans began to take root. The First Bank of the United States was modeled after the very same Bank of England that many of the founders so despised, but differed in many ways from today's central banks. For example, it was partly owned by foreigners, who shared in its profits.

Also, it was only responsible for roughly 20% of the currency supply; state banks accounted for the rest.

Several founding fathers bitterly opposed the bank, while the international money changers (Rothschild, Schiff, Warburg, etc.) celebrated. Thomas Jefferson saw it as an engine for speculation, financial manipulation, and corruption. (#)(#) In contrast to Hamilton, Jefferson believed that states should charter their own banks and that a national bank unfairly favored wealthy businessmen in urban areas over farmers in the country.

In 1811, its twenty-year charter expired and was not renewed by Congress despite threats from Nathan Rothschild, a central banker from England who said,

“Either the application for renewal of the charter is granted, or the United States will find itself involved in a most disastrous war.”(#)

A year later, as promised, thousands of Americans would have to die in a war against Britain. It could have been worse, but the brits were still fighting Napolean and couldn’t mount much of an assault. The war ended in 1814 with America undefeated. (#)

Five years later, the Federal Government would charter its successor, the Second Bank of the United States. James Madison signed the charter with the intention of stopping the runaway inflation that had plagued the country during the five-year interim. It was essentially a copy of the First Bank, with branches across the country. (#)

Andrew Jackson, who became president in 1828, denounced the new bank as an “engine of corruption.” On September 10, 1833, Jackson announced that the government would no longer use the Second Bank of the United States, the country's national bank. He then used his executive power to remove all federal funds from the bank in the final salvo of what is referred to as the “Bank War." (#) Jackson was unable to get the bank dissolved but refused to renew its charter, which ended in 1836.

The banking world then went through 2 distinct periods in the lead-up to the story at hand: the “free banking” era, followed by the "national banks” era. which lasted right up until the creation of the Federal Reserve System.

Financial False Flags and the Creation of the Federal Reserve

Let's pause here for a moment to familiarize ourselves with some names that will be important going forward.

For anyone who is unfamiliar with the Rothschild banking dynasty, let’s just say the family and its branches have been supremely influential over the last half millennia throughout the civilized world, particularly in regard to central banking.

Kuhn, Loeb & Co, was an American multinational investment bank founded in 1867 by Abraham Kuhn and his brother-in-law, Solomon Loeb. Under the leadership of Jacob H. Schiff, Loeb's son-in-law and alleged Rothschild agent (#), it grew to be one of the most influential investment banks in the late 19th and early 20th centuries. (#)

Another key player in the events to follow was alleged Rothschild agent J.P. Morgan. Morgan was the founder of J.P. Morgan and Co, which was a predecessor of three of the largest banking institutions in the world; Chase Manhattan, Morgan Stanley, and Deutsche Bank. (#)

In the early 1900s, the money changers of the world had already been anxious to set up another private central bank for America. (#) Alleged Rothschild crony Jacob Schiff, then head of Kuhn, Loeb, and Co., said in a speech to the New York Chamber of Commerce,

"Unless we have a Central Bank with adequate control of credit resources, this country is going to undergo the most severe and far reaching money panic in its history."(#)

The quote has been interpreted as an admonition by some and as a threat by others. Soon after would come the year that the banksters went on the offensive.

It is widely believed that in 1907, J.P. Morgan and his cohorts, colloquially known as “the money trust," secretly crashed the stock market. The group was aware that thousands of small banks were vastly overextended; some only had reserves of 1% under the fractional reserve principle. Soon, bank runs would suddenly become commonplace across the nation. (#)(#)

The commonly accepted story is that copper magnate F. Augustus Heinze, who was also depicted as an overzealous Wall Street banker, attempted to corner the copper market, which, through a series of convoluted events, resulted in a run on many major banks. At the height of the panic, J.P. Morgan arrived to save the banking community and quell the massive drop in bank reserves and market collapse in an act of heroic altruism.

Morgan was then touted as a beacon of financial wisdom and the savior of the nation. (#)

Morgan swooped in and absorbed the Mercantile Trust and six more trust companies and banks, including the two largest banks that were hit the hardest: The Trust Company of America and Lincoln Trust. Morgan’s Guarantee Trust and Manhattan Trust companies would control them, with the Rothschild family's US emissary, August Belmont (#), at the helm of the merger. He promised Charles Barney that he would help to save the Knickerbocker Trust, one of the largest trust companies in the country and a competitor of his Bankers’ Trust Co., but in an act of calculated cruelty, he decided to pull the plug at the last minute.

Soon after that, Barney committed suicide.

In 1908, with the widespread financial panic over, Morgan was hailed as a hero by the then President of Princeton University, Woodrow Wilson, who even crassly if not arrogantly stated,

"All this trouble could be averted if we appointed a committee of six or seven public spirited men like J.P. Morgan, to handle the affairs of our country." (#)

However, according to many of those who’ve rigidly examined his actions, Morgan was a monster who fed off the economic destruction. Regardless of either interpretation, because of Morgan’s actions, banking power was now further consolidated into the hands of a few large banks. Not only that, but the dubious and unpredictable assault on New York City banks ended up becoming the catalyst for one of the largest cases of corporate consolidation in American history.

We’ll come back to why all of this framing is important eventually. Bear with me and you’ll see the grand design …

In the wake of the turmoil, President Theodore Roosevelt signed into law a bill creating the "National Monetary Commission." (#) This commission was supposed to study the banking problem and make recommendations to Congress. Naturally, the commission was packed with friends and cronies of the financial elite.

The chairman of the commission was Senator Nelson Aldrich from Rhode Island, who represented Newport, Rhode Island, home of America's richest banking families, so, in short, he was well connected. (#)

The Aldrich family would merge with the Rockefellers, creating one of America’s most deeply ingrained elite bloodlines. His daughter would marry John D. Rockefeller Jr., and together they would have five sons (including Nelson Rockefeller, who would become Vice President in 1974, and David Rockefeller, who would become Head of the Council on Foreign Relations). (#)(#)(#)

Following the setting up of this National Monetary Commission, Senator Aldrich immediately embarked on a 2-year fact-finding tour of Europe, where he consulted at length with the private central bankers in England, France, and Germany,(#) all of which were controlled by the Rothschilds. (#) Aldrich returned from his two-year European fact-finding mission on the 22nd of November. Shortly afterward, some of America's most wealthy and powerful men boarded Senator Aldrich's private railcar in the strictest secrecy, presumably with the intention of capitalizing on the recent instability and creating a new central bank—one that would withstand the test of time.

[The story that follows has been recounted by G. Edward Griffon in his work, “The Creature from Jekyll Island.”

Although Griffon did take many creative liberties, some aspects of the book remain true, while others are contested.]

In this group was Paul Warburg, who was at the time earning a $500,000 a year salary from the aforementioned Rothschild-owned firm, Kuhn, Loeb & Company. This salary was ostensibly for him to lobby for a privately owned central bank in America.(#)

Also present was Jacob Schiff. It is important to note that since the Rothschilds, Warburgs, and Schiffs are all interconnected by marriage, these participants were essentially the same extended family.(#)(#)(#)

Secrecy at this meeting was said to be so tight that all the participants were cautioned to use only first names, to prevent servants from learning their identities.

The critics of those who focus on Jekyll Island have been consistently snide and condescending in their remarks.

The general consensus of their criticisms is that the Jekyll Island meeting is just conspiratorial nonsense. But none of these critics were present, and the historical documentation of those who were suggests plenty of conspiracy.

Years after the meeting, one participant, Frank Vanderlip, President of National Citibank and a representative of the Rockefeller family, confirmed the Jekyll Island trip in an edition of the Saturday Evening Post in which he stated,

"I was as secretive indeed, as furtive as any conspirator ... Discovery we knew, simply must not happen, or else all our time and effort would be wasted. If it were to be exposed that our particular group had got together and written a banking bill, that bill would have no chance whatever of passage by Congress."(#)

It was not just the setting up of a Central Bank that was on the agenda. Other problems for these bankers included: firstly, HOW to get the other 20,000 national banks under their control, and secondly, the nation’s economy was so strong that corporations were starting to finance their own expansions out of profits instead of taking out huge loans from large banks. (#)

Basically, American Industry was becoming independent of the money changers, and the money changers were not about to let that happen.

On the other side of the Jekyll Island excursion, the “Aldrich bill” was presented to Congress for debate.

The “Aldrich bill” was very quickly identified as a bill to benefit the bankers. This rubbed a lot of people the wrong way, including some members of Congress. A congressional subcommittee called the Pujo Committee was created and tasked with investigating Morgan along with several other wall street bankers.

This is where J.P. Morgan and the panic of 1907 we mentioned earlier come full circle.

The Committee’s report found that Morgan and others, including Rockefeller, Warburg, and Schiff, had gained control of major manufacturing, transportation, mining, telecommunications, and financial markets throughout the United States. (#)(#)(#)

During the debate, a Republican, Charles A. Lindbergh stated,

The real purpose was to get a monetary commission, which would frame a proposition for amendments to our currency and banking laws, which would suit the Money Trust. The interests are now busy everywhere, educating the people in favor of the Aldrich plan. It is reported that a large sum of money has been raised for this purpose. Wall Street speculation brought on the Panic of 1907. The depositors’ funds were loaned to gamblers and anybody the Money Trust wanted to favor. Then when the depositors wanted their money, the banks did not have it. That made the panic.(#) "The Aldrich plan is the Wall Street Plan. It means another panic, if necessary, to intimidate the people. Aldrich, paid by the government to represent the people, proposes a plan for the trusts instead."(#)

Now you know why J.P. Morgan's financial false flag was such a crucial part of all of this. Many people at the time believed that the Panic of 1907 had been premeditated and manufactured by the Wall Street elites to gain ultimate control over banking and industry in America, but no action would ever be taken against the larger-than-life moguls.

As this debate carried on, the bankers realized they didn't have enough support, and the Republican leadership never brought the Aldrich bill to a vote. Instead, the bankers decided to switch their attention to the Democrats and started heavily financing Woodrow Wilson, the Democratic Presidential nominee.

Wall Street banker Bernard Baruch, was put in charge of the Wilson project, and, as historian James Perloff stated,

"Baruch brought Wilson to the Democratic Party headquarters in New York in 1912, 'leading him like one wood a poodle on a string.' Wilson received an, 'indoctrination course,' from the leaders convened there...." (#)

On November 5th, Woodrow Wilson was elected, and J. P. Morgan, Paul Warburg, Bernard Baruch, et al, advanced a new plan that Warburg called the Federal Reserve System. The leadership of the Democratic Party hailed this new bill called the "Glass-Owen Bill," as totally different from the Aldrich bill, when in fact it was virtually identical. (#)

Despite the blatant similarities, senator Aldrich, and Frank Vanderlip, then President of Rockefeller's National Citibank of New York, would publicly state their opposition to the bill in order to make people think that the bill proposed was radically different from the Aldrich bill. This posturing alone was enough to quell the public’s suspicions.

Frank Vanderlip, once again, blew the lid years later in the Saturday Evening Post,

"Although the Aldrich Federal Reserve Plan was defeated when it bore the name Aldrich, nevertheless its essential points were all contained in the plan that finally was adopted."(#)

As Congress neared a vote on the Glass-Owen Bill, an Ohio attorney named Alfred Crozier noticed the similarities between the two bills despite the manipulated public discourse and subsequently stated (#):

"The ... bill grants just what Wall Street and the big banks for twenty-five years have been striving for - private instead of public control of currency. It [the Glass-Owen Bill] does this as completely as the Aldrich Bill. Both measures rob the government and the people of all effective control over the public's money, and vest in the banks exclusively the dangerous power to make money among the people scarce or plenty."(#)

The debate appeared to not be going well for the bankers; senators were beginning to say that the bill was corrupt and deceitful; it was beginning to look like Aldrich Bill 2.0 and would surely die on the floor. But the bill was approved by the Senate on December 22nd anyway, to the surprise and dismay of many. How could this have happened?

Simple: the vote took place while many of the senators were home for Christmas, having been assured by the leadership that nothing would be decided regarding the bill until after the holiday recess.(#)

Representative Charles A. Lindbergh was less than thrilled about the Bill, and voiced his opinion:

"This Act establishes the most gigantic trust on earth. When the President signs this bill, the invisible government of the monetary power will be legalized. The people may not know it immediately, but the day of reckoning is only a few years removed ... The worst legislative crime of the ages is perpetrated by this banking and currency bill."(#)

Tell us how you really feel, Chuck.

Interestingly, just a few weeks earlier in October, Congress had managed to pass a bill legalizing direct income tax of the people. This was in the form of a bill pushed through by Senator Aldrich, which is now commonly known as the oft-lamented 16th Amendment. (#)

The income tax law was absolutely fundamental to the Federal Reserve, as the FED would run up an unquenchable federal debt. The only way to guarantee the payment of interest on this debt was to directly tax the people, as they had done with the Bank of England. If the Federal Reserve had to rely on contributions from the States, they would be dealing with bigger entities that could revolt and refuse to pay the interest on their own money, or at least bring political pressure to bear in order to keep the debt small.

On that note, and don’t take this as financial advice, the 16th Amendment may never have been ratified, and as a result, many American citizens do not pay their income tax, and there is really nothing the United States Government can do about it.

[For further information on this, go to thelawthatneverwas.com] (#)

In 1895, the Supreme Court found an income tax law similar to the 16th Amendment unconstitutional. The Supreme Court also found a corporate tax law unconstitutional in 1909. (#)

Another thing that many people just assume is true is the idea that the Federal Reserve is a government agency when, in reality, it is a private company that the government has entered into a contract with. If you are ever in any doubt about how you should see the FED simply consult a phone book (if you can find one in your local museum). You won’t find the FED on government pages but you will find it in the business pages. (#)

This leads us to our next question.

Who owns the FED?

Many people have attempted to discover who “owns the FED.” Of course, despite the fact the Federal Reserve’s own website claims that “no one owns the fed,” there is a paper trail that leads to a handful of the largest banks on earth (#), including:

Rothschild Bank of London

Warburg Bank of Hamburg

Rothschild Bank of Berlin

Lehman Brothers of New York

Lazard Brothers of Paris

Kuhn Loeb Bank of New York

Israel Moses Seif Banks of Italy

Goldman, Sachs of New York

Warburg Bank of Amsterdam

Chase Manhattan Bank of New York

This list was determined primarily by who was involved with the FED’s creation, who FED policy tends to benefit, and the affiliations of the FED’s Board of Governors.

So, in 1914, the FED was up and running, and the First World War was just getting started. In this war, the German Rothschilds loaned money to the Germans, the British Rothschilds loaned money to the British, and the French Rothschilds loaned money to the French. (#) which is interesting, to say the least. Probably a great business model, as nothing quite gets the economy moving like a good war.

But I digress.

One year after the passage of the Federal Reserve Bill, Representative Charles A. Lindbergh Sr. outlined how The Federal Reserve created the "business cycle," and how they manipulated that to their own advantage.

"To cause high prices, all the Federal Reserve Board will do will be to lower the rediscount rate ... producing an expansion of credit and a rising stock market, then when ... business men are adjusted to these conditions, it can check ... prosperity in mid-career by arbitrarily raising the rate of interest. It can cause the pendulum of a rising and falling market to swing gently back and forth by slight changes in the discount rate, or cause violent fluctuations by a greater rate variation, and in either case it will possess inside information as to financial conditions and advance knowledge of the coming change, either up or down. This is the strongest, most dangerous advantage ever placed in the hands of a special privilege class by any Government that ever existed. The system is private, conducted for the sole purpose of obtaining the greatest possible profits from the use of other people's money. They know in advance when to create panics to their advantage. They also know when to stop panic. Inflation and deflation work equally well for them when they control finance."

By 1916, President Wilson had begun to realize the gravity of the damage he had done to America by unleashing the Federal Reserve on the American people.

"We have come to be one of the worst ruled, one of the most completely controlled governments in the civilized world - no longer a government of free opinion, no longer a government by ... a vote of the majority, but a government by the opinion and duress of a small group of dominant men. Some of the biggest men in the United States, in the field of commerce and manufacture, are afraid of something. They know there is a power somewhere so organized, so subtle, so watchful, so interlocked, so complete, so pervasive, that they had better not speak above their breath when they speak in condemnation of it."(#)

Just before his death, Woodrow Wilson would make the following statement in relation to his support for the Federal Reserve:

"I am a most unhappy man. I have unwittingly ruined my country. A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men." (#)

Pretty hot take there, Woody.

Badlands Media articles and features represent the opinions of the contributing authors and do not necessarily represent the views of Badlands Media itself.

If you enjoyed this contribution to Badlands Media, please consider checking out more of my work for free at Underground Newswire.

SOURCE: Badlands Media

The College of Contract Management is redefining how professionals learn online. Its commitment to live, interactive education creates a stimulating environment where ideas and experiences are exchanged freely. The institution’s curriculum covers a wide range of subjects tailored for working individuals, blending flexibility with academic depth. Students benefit from direct tutor support, comprehensive resources, and career-oriented training that prepares them for success in competitive fields.